The Corporate Sustainability Reporting Directive (CSRD)

Part two in a series of four articles by Svarmi on the European Union's green action plan, taxonomy and what these policies mean for the reporting and transparency requirements for companies in 2022 and beyond.

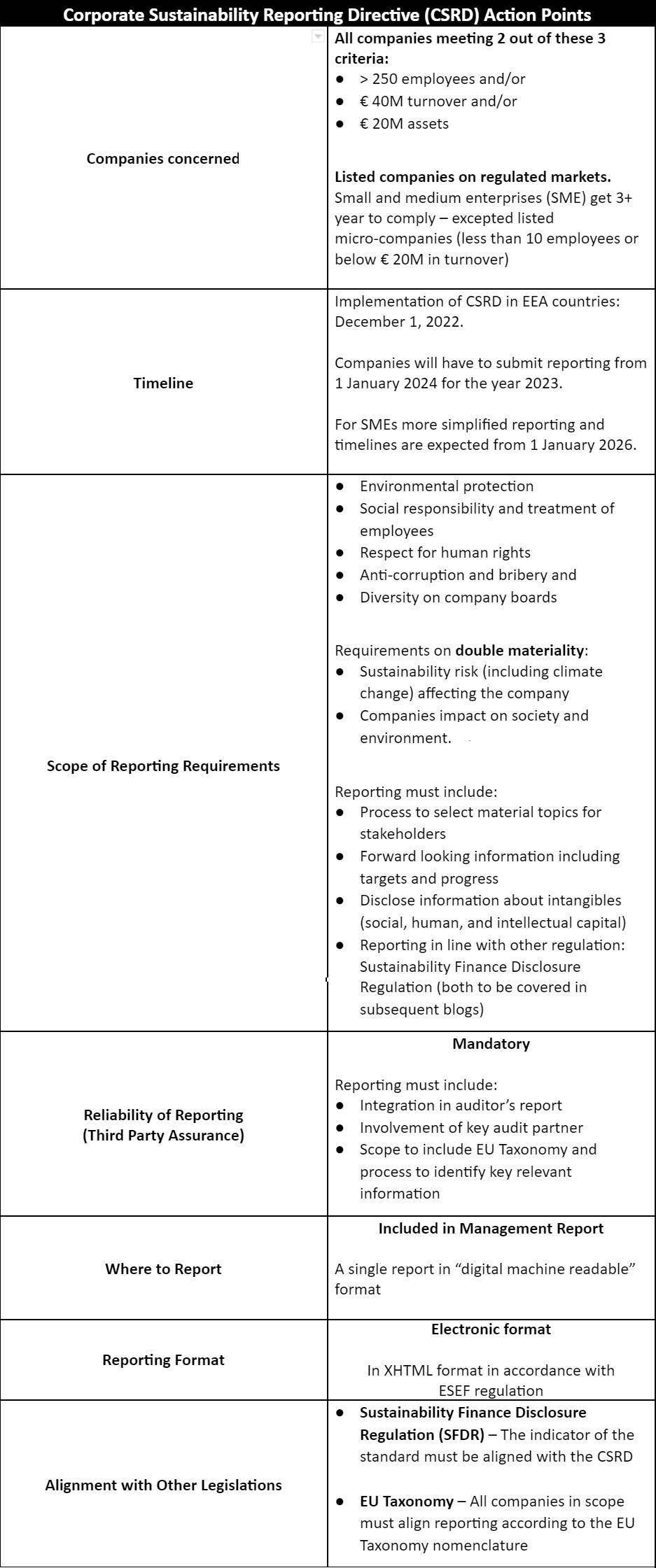

Based on the EU 10-Point Action Plan, the EU adopted the Corporate Sustainability Reporting Directive (CSRD) to help improve money flow towards sustainable activities across the European Union. This new legislation comes into play as Environmental, Social and Governance (ESG) reporting (covered in our previous blog) gains momentum. With its new requirements, the EU is tackling the problem of quality reporting by establishing a common reporting framework. Also, the CSRD aims to ensure that businesses report reliable and comparable sustainability information to re-orient investments towards more sustainable technologies and companies.

The CSRD is the new EU legislation requiring all large companies to publish regular reports on their environmental and social impact activities. With the directive, the Commission is giving sustainability reporting a similarly important status to financial reporting. In future, sustainability reporting should no longer be carried out separately, but should be part of the management report of companies.

The main goal of the CSRD is to increase the economic flow towards more sustainable business models throughout the European Union and demands companies to share information on how they monitor and manage both social and environmental issues.

The corporate social responsibility (CSR) report is an internal- and external-facing document companies used to communicate CSR efforts and their impact on the environment and community. According to the European Commission, the sustainability report should provide concrete information on the understanding of the business development, the business result, the situation of the company as well as containing the effects of its activities on people and the environment. This consideration of internal and external impacts relevant to sustainability is also referred to as the principle of dual materiality. Companies must also provide information on intangible assets such as human and intellectual capital. Also new is the requirement to provide retrospective and forward-looking disclosures on governance factors such as reporting on targets and progress.

Companies are also obligated to explain financial partnerships to stakeholders, set new environmental and social targets to ensure improvement, share any information that could impact said progress, and to ensure that their sustainability reports for the CSRD adhere to the regulations disclosed in the EU taxonomy regulation and SFDR, otherwise known as the Sustainable Finance Disclosure Regulation (SFDR).

In future, sustainability reporting should no longer be carried out separately, but should be part of the management report of companies. The sustainability report should provide concrete information on the understanding of the business development, the business result, the situation of the company as well as containing the effects of its activities on people and the environment. Companies must also provide information on intangible assets such as human and intellectual capital. Also new is the requirement to provide retrospective and forward-looking disclosures on governance factors such as reporting on targets and progress. CSR reporting becomes as important as financial reporting.

The expectation is that CSR reporting be included as part of the Annual Report. EU Commission will require that the content of the CSRD be audited – although timetable has not been set. The CSRD also requires companies to obtain a certificate before reporting their current sustainability measures as an attempt to ensure greater transparency of the sustainability information provided. This will be done by requesting proof of the certificate in a pre-dispositioned section of the sustainability reports.

Compliance is happening soon: companies must submit their report aligning with the CSRD on 1 January 2025, for the 2024 financial year. It will be challenging for reporting companies, as data collection and auditing is an arduous process requiring time and resources. From 1 January 2026, all reporting obligations are to be extended to all listed small and medium-sized enterprises (SMEs). However, the directive provides for simplified reporting obligations for listed SMEs in order to minimize their burden. Only the smallest organizations are to be exempt from the reporting obligation in the future.

EEA States will have to transpose the CSRD by 1st December 2022 and ensure that its provisions apply to companies for the financial year starting on 1 January 2023 or during the calendar year 2023. Once the transposition measure is adopted, it is enforced through the national administrative mechanisms applicable to national law. It is unknown exactly when the EU Commission will sanction businesses failing to comply with the CSRD. According to the Commissions' requirements within the Directive, the sanctions can be expected to be significant. The nature of the sanctions and the fines' amount will depend on the different Member States. When Iceland transposes the law, sanctions will be announced.

This brings changes in the future of sustainability reporting. If your company must comply with the CSRD, you must act now. 2023 is closer than it seems. To be fully prepared, businesses should start collecting data now. Svarmi helps companies assess their nature & biodiversity impact by locating, prioritizing, and digitally evaluating their Areas of Influence, driving alignment to regulatory requirements as well as the framework being developed by the Taskforce on Nature-related Financial Disclosures (TNFD).

Similar articles

Svarmi concludes 100+ Accelerator pilot with AB-InBev

The Journey to Nature Positive – Adaptations to an ever-changing world