The European Union's 10 Point Action Plan

Part one in a series of four articles by Svarmi on the European Union's green action plan, taxonomy and what these policies mean for the reporting and transparency requirements for companies in 2022 and beyond.

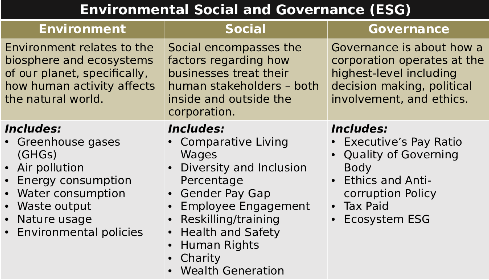

On 7 March 2018, the European Commission released an action plan for financing sustainable growth. The ten (10) point action plan aims to leverage financial markets in order to address sustainability challenges, especially those related to climate change. The EU’s Action Plan is part of the implementation of both the wider Paris Agreement on climate change and the UN 2030 Agenda for Sustainable Development and is a response to the recommendations of a report produced by the High-Level Expert Group on Sustainable Finance in January 2018. The goal being that Environmental, Social and Governance (ESG) factors will be at the forefront of every decision and no longer viewed as preferential considerations in the investment process. ESG refers to the three key factors when measuring the sustainability and ethical impact of an investment in a business or company.

The Action Plan outlines ten reforms in three areas:

Reorient capital flows towards sustainable investment, in order to achieve sustainable and inclusive growth

- Establishing an EU classification system for sustainability activities

- Creating standards and labels for green financial products

- Fostering investment in sustainable projects

- Incorporating sustainability when providing investment advice

- Developing sustainability benchmarks

Mainstreaming sustainability into risk management

- Better integrating sustainability in ratings and research

- Clarifying institutional investors and asset managers’ duties

- Incorporating sustainability in prudential requirements

Foster transparency and long-termism in financial and economic activity

- Strengthening sustainability disclosure and accounting rule making

- Fostering sustainable corporate governance and attenuating short-termism in capital markets

In May 2018, the Commission adopted an initial package of measures implementing several key actions to address areas of the Action Plan. The first legislative measures proposed by the Commission to implement four of the actions set out in the action plan, namely taxonomy, investment advice, sustainability benchmarks and investor duties. The package includes:

- Taxonomy

A proposal for a regulation to establish a framework to facilitate sustainable investment. The proposed regulation establishes the conditions and the framework to create, over time, a unified classification system (or taxonomy) on what can be considered environmentally sustainable economic activities. This is widely seen as a first and essential enabling step in the overall effort to channel investments into sustainable activities.

- Investment Advice / Disclosure and Duties

A proposal for a regulation on disclosures relating to sustainable investment and sustainability risks. This regulation will introduce obligations on institutional investors and asset managers to disclose how they integrate ESG factors in their risk processes. Requirements to integrate ESG factors in investment decision-making processes, as part of their duties towards investors and beneficiaries, will be further specified through delegated acts.

- Sustainability Benchmarks

A proposal for a regulation amending the benchmark regulation. The proposed amendment will create a new category of benchmarks, comprising low-carbon and positive carbon impact benchmarks, to help investors better understand the relative carbon impact of their investments.

- Investors Duties / Sustainability Preferences (consultation)

In addition, the Commission has solicited feedback on amendments to delegated acts under the Markets in Financial Instruments Directive (MiFID II) and the Insurance Distribution Directive to include ESG considerations into the advice that investment firms and insurance distributors offer to their clients.

This has led to the development and implementation of the following directives and regulations that we will cover in detail in subsequent blogs:

- Corporate Sustainability Reporting Directive (CSRD)

CSRD introduces new reporting obligations for companies with 250 or more employees. It demands companies to share information on how they monitor and manage both social and environmental issues. With the directive, the European Commission is giving sustainability reporting a similarly important status to financial reporting.

- Sustainable Finance Disclosure Regulation (SFDR)

The SFDR requires that asset-management companies provide information about their investments' environmental, social, and governance risks as well as their impact on society and the planet. The main aim of the SFDR is to increase transparency and comparability of ESG information for end investors to minimize greenwashing. Practically speaking, this means that manufacturers (Financial Market Participants) and advisers will need to provide this information on their public websites. For products (funds, managed products, models), it means additional information will need to be added to pre-contractual documents and periodic publications. The goal is to channel capital flows towards sustainable investment while managing financial risks stemming from ESG issues.

- EU Taxonomy Regulation

In order to introduce a common language and common requirements, the European Commission has developed the EU Taxonomy Regulation. The EU Taxonomy Regulation is a classification tool to determine whether an economic activity is environmentally sustainable. It helps investors, companies, and policy makers to make more informed decisions by identifying activities that are deemed to make substantial contributions to environmental objectives and thereby help to finance the transition to a more

sustainable economy. The taxonomy provides an EU-wide classification system that establishes a list of environmentally sustainable economic activities.

This year brings regulatory proposals and implementations for sustainable investment(s) in Europe, and we anticipate the need for more structure and consistency going forward particularly in the six environmental objectives defined by the EU Taxonomy Regulation:

- Climate change mitigation

- Climate change adaption

- Sustainable use and protection of water and marine resources

- Transition to a circular economy, waste prevention and recycling

- Pollution prevention and ion control

- Protection of healthy ecosystems (biodiversity)

This brings changes in the future of sustainability reporting. Svarmi is focused on assisting companies in locating, prioritising, and evaluating nature impact within their Areas of Influence as per existing frameworks, such as Environmental Impact Assessments, as well as the emerging Taskforce on Nature-related Financial Disclosures (TNFD) framework. Svarmi continues to align its solution offering to the rapidly changing regulatory environment and stakeholder requests for greater transparency.

.jpeg)